401k distribution calculator fidelity

Conveniently access your Fidelity workplace benefits such as 401k savings plans stock options health savings accounts and health insurance. 401k withdrawals are an option in certain circumstances.

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA.

. Ad This guide may help you avoid regret from certain financial decisions with 500000. Please refresh the page or try again later. Fidelity Investments - Retirement Plans Investing Brokerage Wealth.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. The sustainable withdrawal rate is the estimated percentage of savings youre able to withdraw each year throughout retirement without running out of money. Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans.

Sorry something went wrong. All tax calculators tools. Ad Get Help Rolling Over Your Old 401k Account to a Fidelity IRA.

Second many employers provide. Ad Get Help Rolling Over Your Old 401k Account to a Fidelity IRA. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you.

401k Withdrawal Calculator. Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA. You only pay taxes on contributions and earnings when the money is withdrawn.

Using this 401k early withdrawal calculator is easy. To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation. Click here to learn ways Fisher Investments delivers clearly better money management.

The Planning Guidance Center helps make it easy to get a holistic view of your financial plan from one place. Use the Contribution Calculator to see the. But what long-term gains are you giving up for cash on hand now.

When you make a pre-tax contribution to your. This calculator is for educational use only illustrating how different user situations and decisions affect a hypothetical retirement income plan and should not be the basis for any investment or. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate.

If you need to tap into retirement savings prior to 59½ and want to avoid an early distribution penalty this calculator can be used to determine the allowable distribution amounts under. Understand What is RMD and Why You Should Care About It. With this tool you can see how prepared you may be for retirement review and.

Use this interactive tool to see how charitable giving can help you save on taxesand how accelerating your giving with the bunching strategy may help save even. First all contributions and earnings to your 401 k are tax-deferred. Find Fresh Content Updated Daily For Retirement drawdown calculator.

If you dont have data ready.

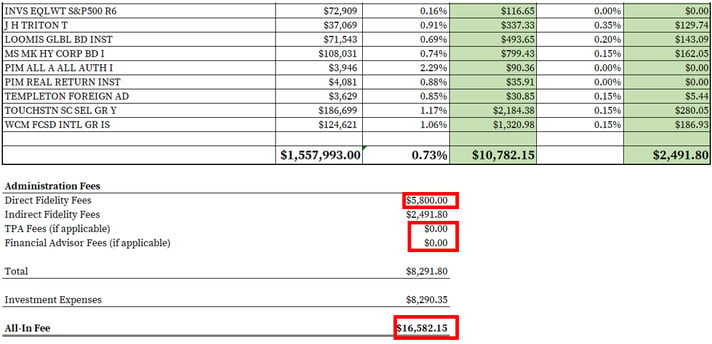

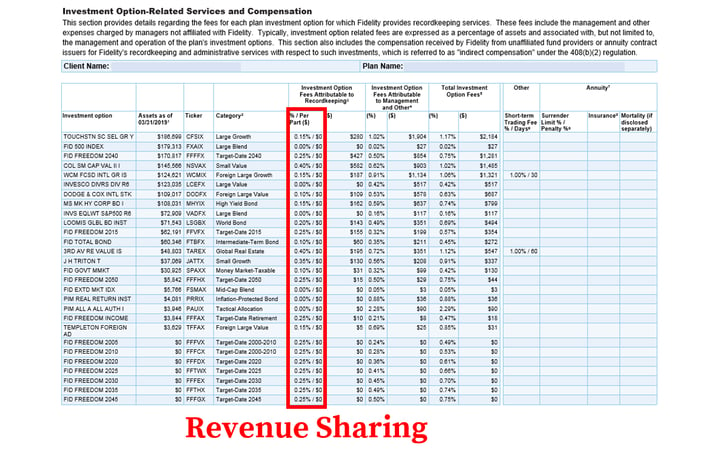

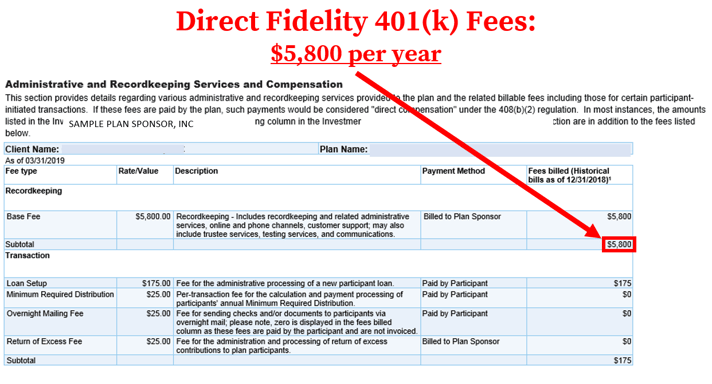

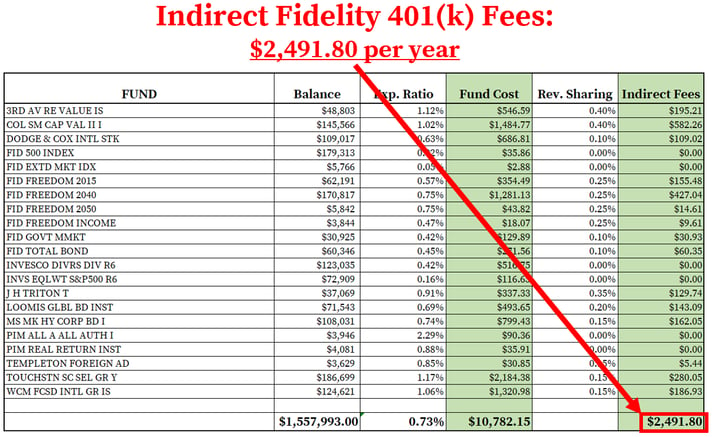

How To Find Calculate Fidelity 401 K Fees

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

Retirement

Retirement Planning And Guidance Fidelity

Financial Calculators Tools Fidelity

Listing Of All Tools Calculators Fidelity

How To Find Calculate Fidelity 401 K Fees

3

How To Find Calculate Fidelity 401 K Fees

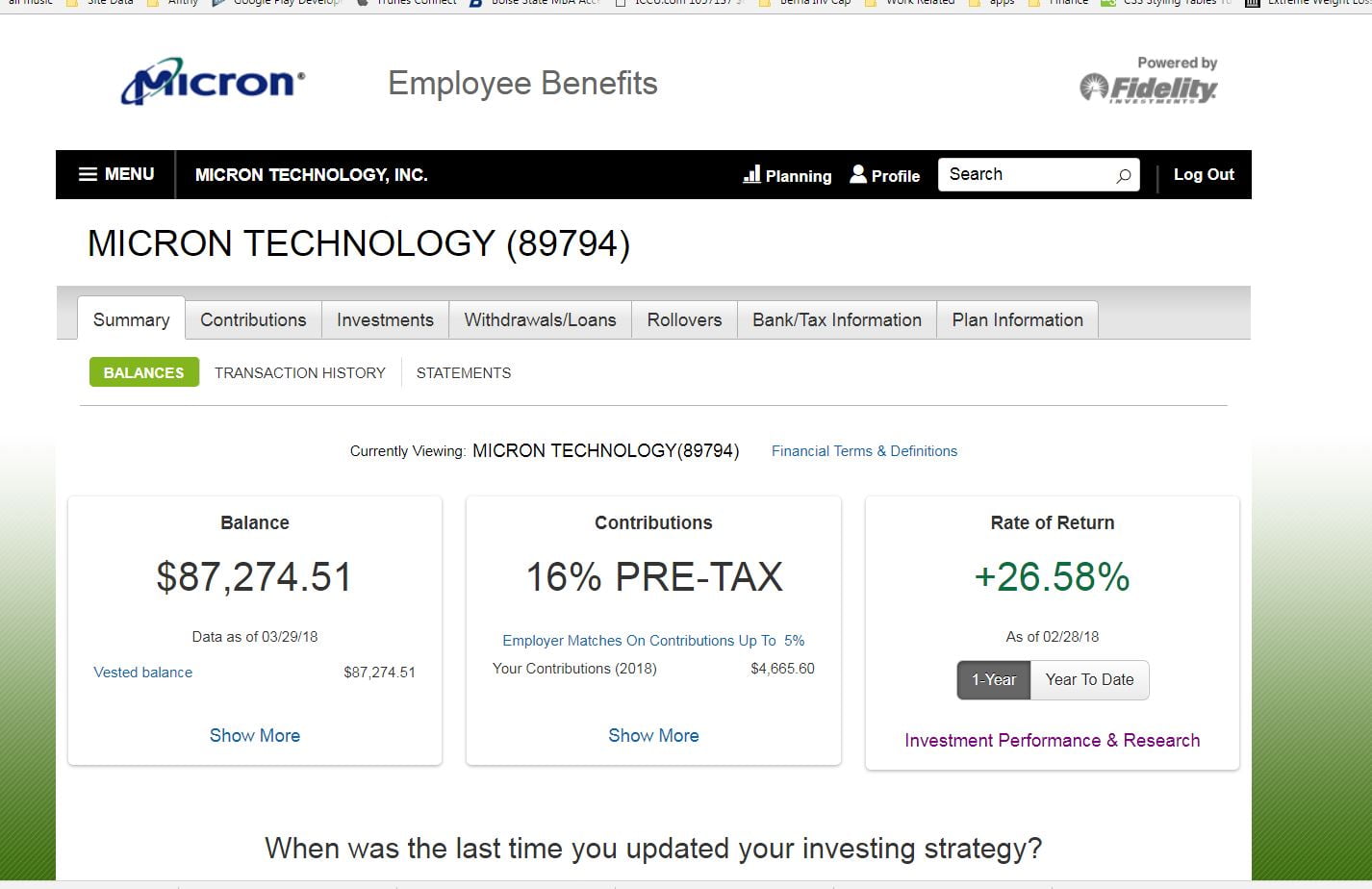

401k Fidelity Net Benefits Our Debt Free Lives

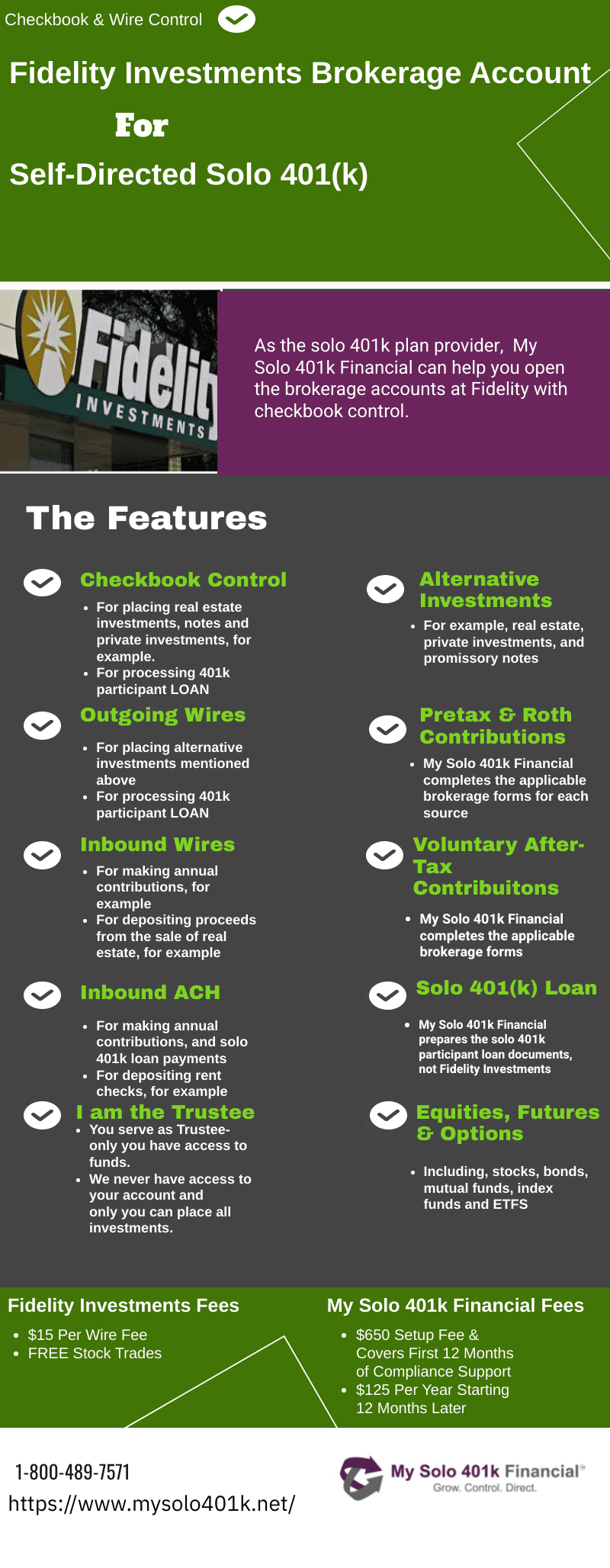

Fidelity Solo 401k Brokerage Account From My Solo 401k

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Investing

3

1

Contributing To Your Ira Start Early Know Your Limits Fidelity

K5ogqp86k Lmgm